Such decision-making is common to companies that manufacture a diversified portfolio of products, and management must allocate available resources in the most efficient manner to products with the highest profit potential. Where C is the contribution margin, R is the total revenue, and V represents variable costs. The contribution margin and the variable cost can be expressed in the revenue percentage. These are called the contribution margin ratio and variable cost ratio, respectively. As long as the data entered into the database is correct, both reports can be prepared in a matter of minutes.

How to Improve Contribution Margin

Let’s dive into how variable costs affect something called the contribution margin. This is a big deal for any business because it helps them figure out how much money they can make after paying for the costs that change. Imagine you have a lemonade stand; the more lemonade you sell, the more sugar and cups you need. These are your variable costs because they go up or down based on how much lemonade you sell. It shows the percentage of sales revenue that ends up as profit after all expenses are paid. This includes every cost, from making the product to the company’s rent and advertising.

The bottom line on contribution margin income statements

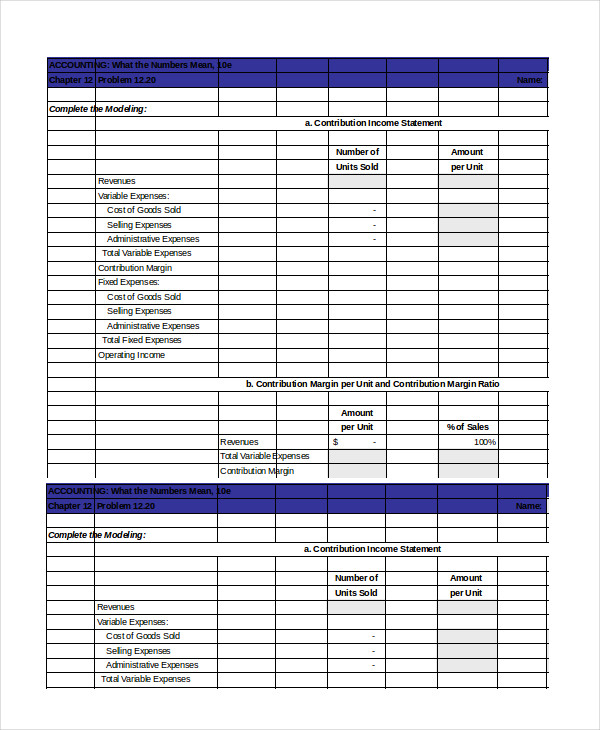

Any remaining revenue left after covering fixed costs is the profit generated. Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount. Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity. There are three primary benefits to the preparation of a contribution income statement. The arrangement of the data lends itself well to various types of analysis, since it is simpler to determine the relationship between cost, volume of production, and the profit generated from that production. Since the data is arranged on the basis of behavior, this form of income statement is also helpful in assessing departmental performance overall and the quality of leadership provided by a departmental manager.

- Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

- It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed.

- Investors examine contribution margins to determine if a company is using its revenue effectively.

- In the absorption and variable costing post, we calculated the variable product cost per unit.

- The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations.

Formula

Now you know all about the contribution margin income statement, how it differs from the traditional income statement, and how to make one. However, knowledge isn’t quite enough if you’ve got reports to create and stakeholders to reassure on top of your day-to-day tasks. Profit margin is calculated using all expenses that directly go into producing the product. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale “contributes” to the company’s total profits.

Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. A contribution margin income statement is a document that tallies all of a company’s products and varying contribution margins together, helping leaders understand whether the company is profitable. It’s a useful tool for making decisions on pricing, production, and anything else that could improve profitability.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more. Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed.

This number is super important because it helps businesses decide which products are worth selling more of and which might be losing money. It considers the sales revenue of a product minus the variable costs (i.e., costs that change depending on how much you sell), like materials and sales commissions. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

Managers at ABC Cabinets would conclude from segment analysis that the fixtures segment is more profitable because it has a higher contribution margin. Using the formulas above, they could also see that the cabinet segment the trouble with stock options needs to generate almost double the sales compared to the fixtures segment to reach the break-even point. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits.